Utah1

Highlights: Paradox Basin, Utah

- Zephyr operates a 25,353 acre leaseholding with a 75% working interest

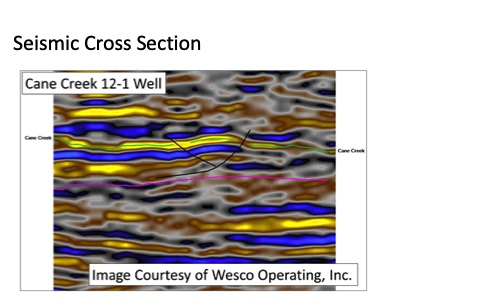

- Excellent 3D seismic across the majority of our position

- Potential for a natural fracture development, which may provide better economics than existing U.S. unconventional resource plays

- Partnership with a U.S. Department of Energy funded research team to increase the geologic understanding and industry awareness of the Paradox Basin

Background

Our predecessor, Rose Petroleum plc, spent over $15 million evaluating and building a position in the Paradox Basin. What were the drivers for that investment?

While the Northern Paradox Basin was not well understood, the Cane Creek Field (20 miles south of Rose’s position) had historically demonstrated significant potential:

Rose’s position was constructed in an area known as the Gunnison Valley – highlights include:

Paradox Basin Holdings Detailed

In 2019, our new management team conducted a full review of the Paradox project, including a detailed look at the historical activity carried out on the project and the farm-in process. The team also reviewed the timeframe and plan for spudding the first project well in line with the expectations of the U.S. Bureau of Land Management (“BLM”), who continue to support the development of the project as soon as commercially possible and in spite of challenging market conditions.

The clear conclusion from this review was that the scale and potential of the project were of sufficient magnitude to justify the Group’s ongoing involvement in the project. The review also concluded that with more favourable positioning and better market conditions, investment from industry and financial partners will be achievable. Furthermore, the review illustrated the need to balance the overall scale of the project with the current market backdrop, timing obligations to the BLM and ongoing holding costs of the significantly sized acreage package.

On the basis of all of these factors, the Board elected to pursue a strategy for the project which included:

- focusing on the most attractive acreage (as identified by the 3D seismic acquisition undertaken by the Group);

- releasing acreage that the Group believed to be non-prospective or on too short a lease to merit further exploration work and/or expenditure; and

- actively acquiring further contiguous acreage in areas the Board considers to have the greatest potential.

Following this review, the Group entered into discussions with its joint venture partner, Rockies Standard Oil Corporation (“RSOC”) to restructure the joint venture in order that the project might be positioned and developed in line with this new strategy.

New Agreement

Following this review, the Group entered into discussions with its joint venture partner, Rockies Standard Oil Corporation (“RSOC”) to restructure the joint venture and position the project so that it could be developed in line with this new strategy. For more information on the restructured partnership and subsequent developments, please see the attached RNS announcements:

DOE Partnership and Grant

A key part of maximising the value of the Paradox asset is increasing the understanding and visibility of the Paradox Basin within a broader group of industry and market participants. As such, the Company was pleased to announce in 2019 that, subject to contract, grant funding from the U.S. Department of Energy (the “DOE”) and the University of Utah may potentially be available to the Company.

Images from the State 16-2 Well Site

Click HERE to see more images on the gallery page